2026 is shaping up to be a turning point for the ShareRing ecosystem. We’re transitioning from heavy infrastructure building and certification work to a phase focused on scaling and growing transaction volume. We’ve spent the last 18 months working through complex compliance requirements and building out our tech stack. Now we’re ready to start seeing returns on that work. Our main focus for 2026 is what we’re calling “Identity Proliferation.” The goal is to embed ShareRing’s self-sovereign identity (SSI) and verification tech across the digital economy: finance, e-commerce, government frameworks, and education. This blog covers how we’re bringing the “Digital Twin” philosophy together into one streamlined interface, while making it straightforward for businesses to plug into our verification services. We know that ease of integration matters to our partners, so we’re focused on enabling merchants to deploy verification workflows without significant technical overhead. We’re also rolling out some new initiatives, including a big push into e-commerce, and the deployment of our “Smart Digital Twin.” This goes beyond just being a wallet. We’re building a trust layer for the digital age.

1. The Strategic Pivot: From Builders to Scalers

We’re making a shift this year. For a while, we’ve been “building the rails” (creating ShareLedger, developing the Vault, and securing certifications like the UK’s DIATF). In 2026, we’re moving to “running the trains.” It’s about volume, utility, and user acquisition now. Having solid tech isn’t enough on its own; we need solutions that are both secure and easy to deploy. That’s why we’re developing the “Self-Service Gateway” in ShareRing Link, so merchants can onboard quickly and start verifying users without delays.

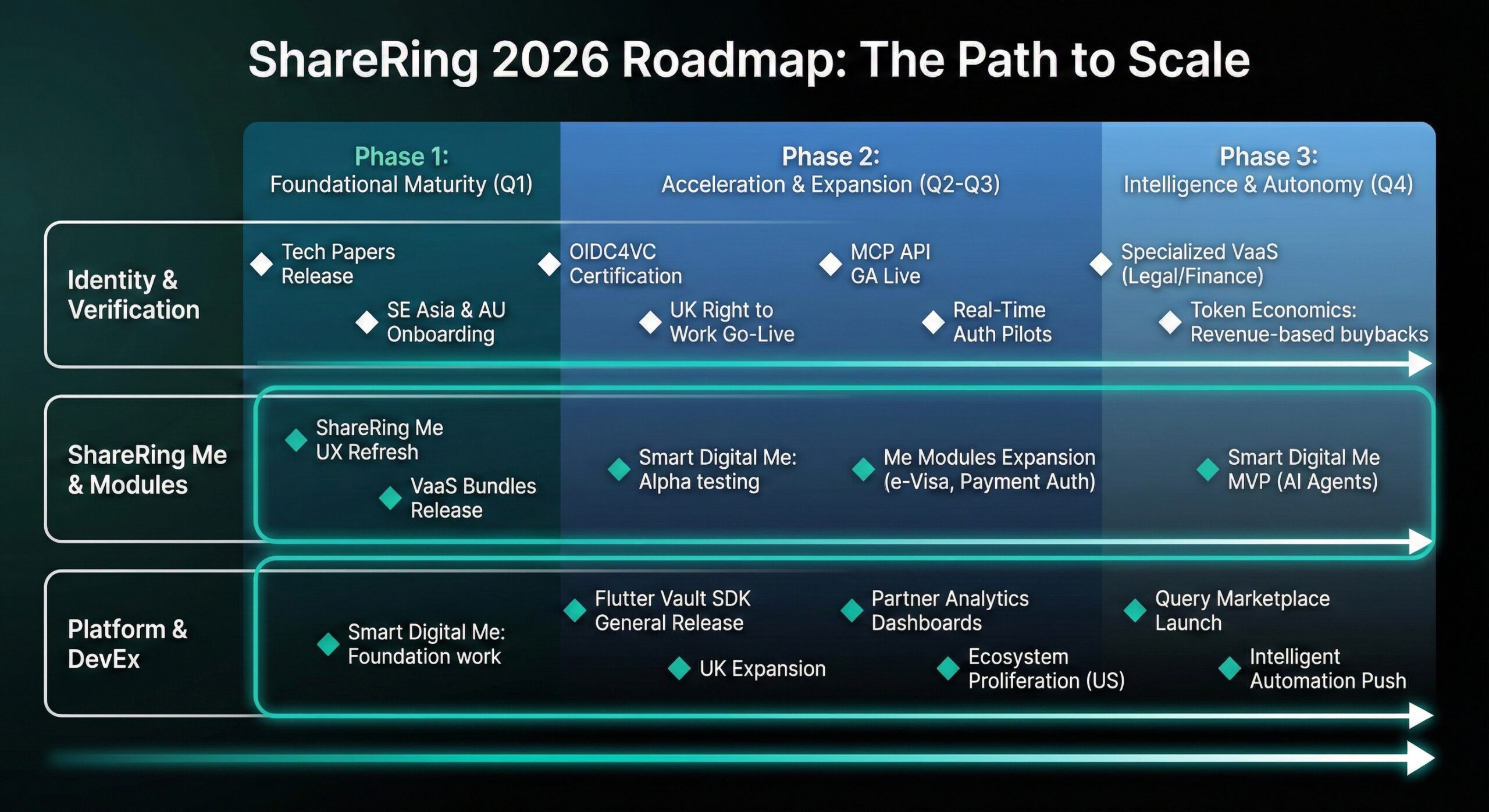

1.1 2026 Rollout Schedule and Key Milestones

Here’s a high-level view of the roadmap. These targets align with where we’re at technically and where we see the market heading.

| Quarter |

Product & Technology Rollout |

Global Sales & Strategy Focus |

Key Commercial Milestones |

| Q1 |

- ShareRing Me UX Refresh: Launch of our unified “Digital Me” interface

- VaaS Bundles: Release of Age and KYC bundled workflows in Link v2

- Tech Papers: Ongoing release of technical whitepapers

- Smart Digital Me: Foundation work for Decentralized AI network

|

- Experience Launch: Focus on user retention and migration

- SE Asia & AU Onboarding: Activation of retail/finance clusters

- Marketing: “Delivery-Led” communication strategy

|

- Tech Credibility: Publication of core protocol papers

- Multiple government level or institutional clients

|

| Q2 |

- OIDC4VC Certification: Self-certification for OID4VCI/OID4VP

- Flutter Vault SDK: General release (already in testing with a partner)

- UK RtW: Commercial go-live for Right to Work checks

|

- UK Expansion: Capitalizing on “voluntary patchwork” policy

- Partner Activation: Formalizing reseller agreements

- Fraud Intel: Joint GTM on fraud signals

|

- Right to Work Volume: Scaling annualized checks

- Smart Digital Me: Alpha testing of Federated AI nodes

- User Growth: Ramp up in primary markets (SE Asia, AU, UK)

|

| Q3 |

- Me Modules Expansion: e-Visa, Payment Auth, and new modules deploying progressively

- MCP API GA: Model Context Protocol services live

- Partner Analytics: Enhanced merchant dashboards

- North America: Focus on Age Verification & Financial Services

|

- Ecosystem Proliferation: Strategic entry into US markets

- VAR Alignment: Joint go-to-market with partners

- Real-Time Auth: Payment gateway integration pilots

|

- US Market Entry: First pilots in regulated sectors

- Revenue: ARR growth milestones

- User Base: Cumulative verified identities growing significantly

|

| Q4 |

- Smart Digital Me MVP: Beta launch of decentralized AI agents

- Query Marketplace: Custom workflow marketplace launch

- Specialized VaaS: High-assurance packs (Legal/Finance)

- Token Economics: Revenue-based buybacks active

|

- Intelligent Automation: Marketing push on AI identity

- Token Utility: Full implementation of buyback mechanism

- Scale: National rollouts in secondary markets

|

- Token Buyback: Execution of first revenue-based large scale buyback

- Transaction Scale: Targeting significant on-chain verifications annualized

|

2. Strategic Context: The Opportunity

Our 2026 roadmap follows a playbook for projects transitioning from infrastructure building to market traction. We’re focused on driving this through fundamental value.

2.1 The Three Pillar Framework

- Foundational Technological Catalysts:Moving to OIDC4VC and launching “Smart Digital Me” aligns us with key themes for 2026: Modular Identity, Decentralized AI (DeAI), and Interoperability. We’re building infrastructure that supports these trends.

- Deliberate Narrative Engineering:We’re refining how we talk about ShareRing. It’s not just a “wallet app.” From a Web 3 perspective, we’re positioning it as a “Layer 3 Trust Network” and “Privacy-First AI Infrastructure.” For our clients and partners, it’s a “privacy first digital identity”. The technical papers in Q1 will help demonstrate our capabilities to developers and enterprise clients.

- Systematic Community Mobilization:We want our community to be active contributors. We’re exploring ways to reward verifiable actions (educating others, onboarding merchants, creating content) to drive organic growth.

2.2 The Regulatory Tailwind

The regulatory environment is moving in a direction that works for us.

- UK: The shift towards a “voluntary patchwork” of certified providers creates an opening for solutions like ours.

- Europe: eIDAS 2.0 mandates interoperable digital wallets, which aligns with our OIDC4VC approach.

- SE Asia: Governments are pushing for digital transformation, and our infrastructure is positioned to support that.

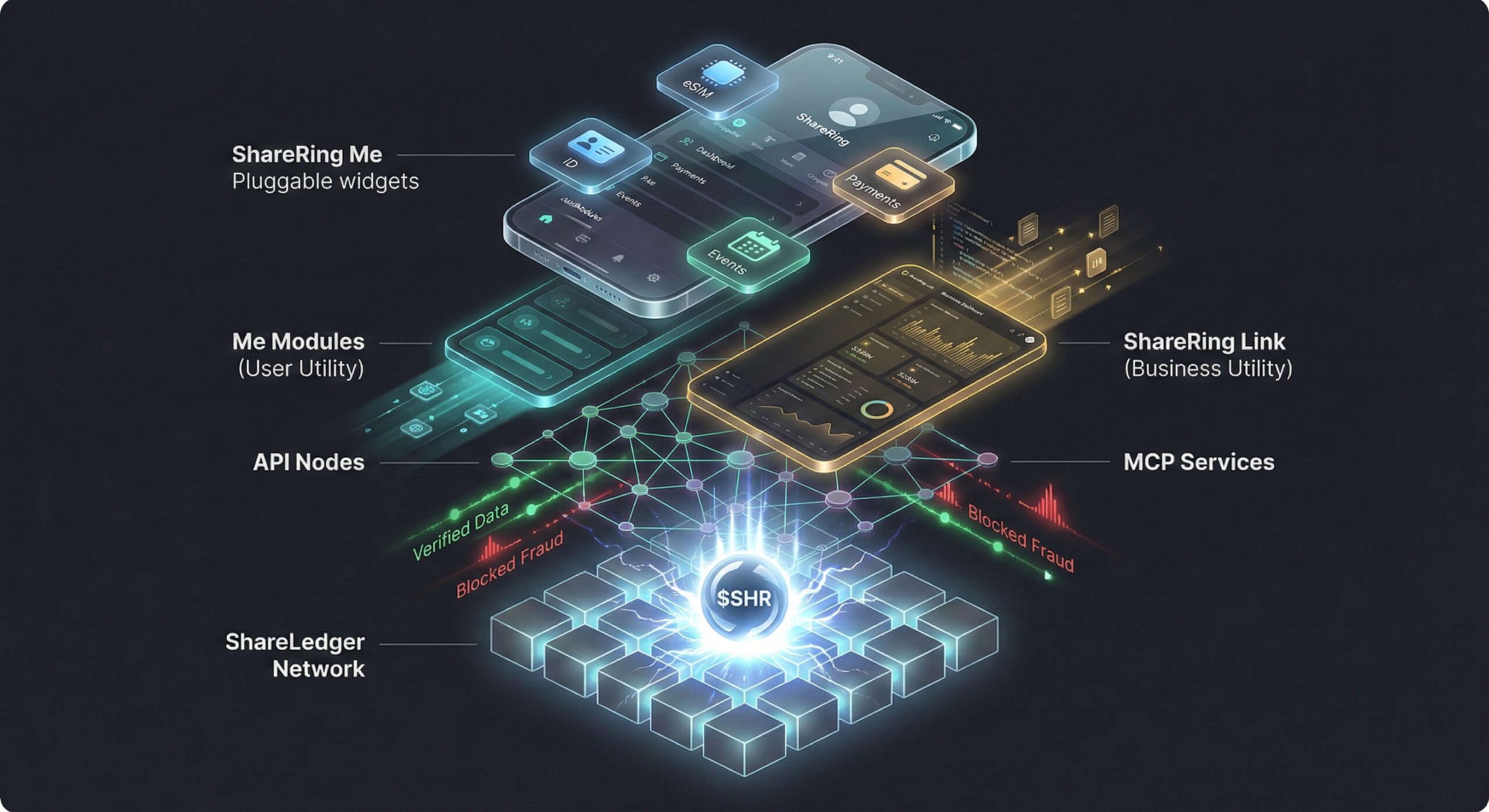

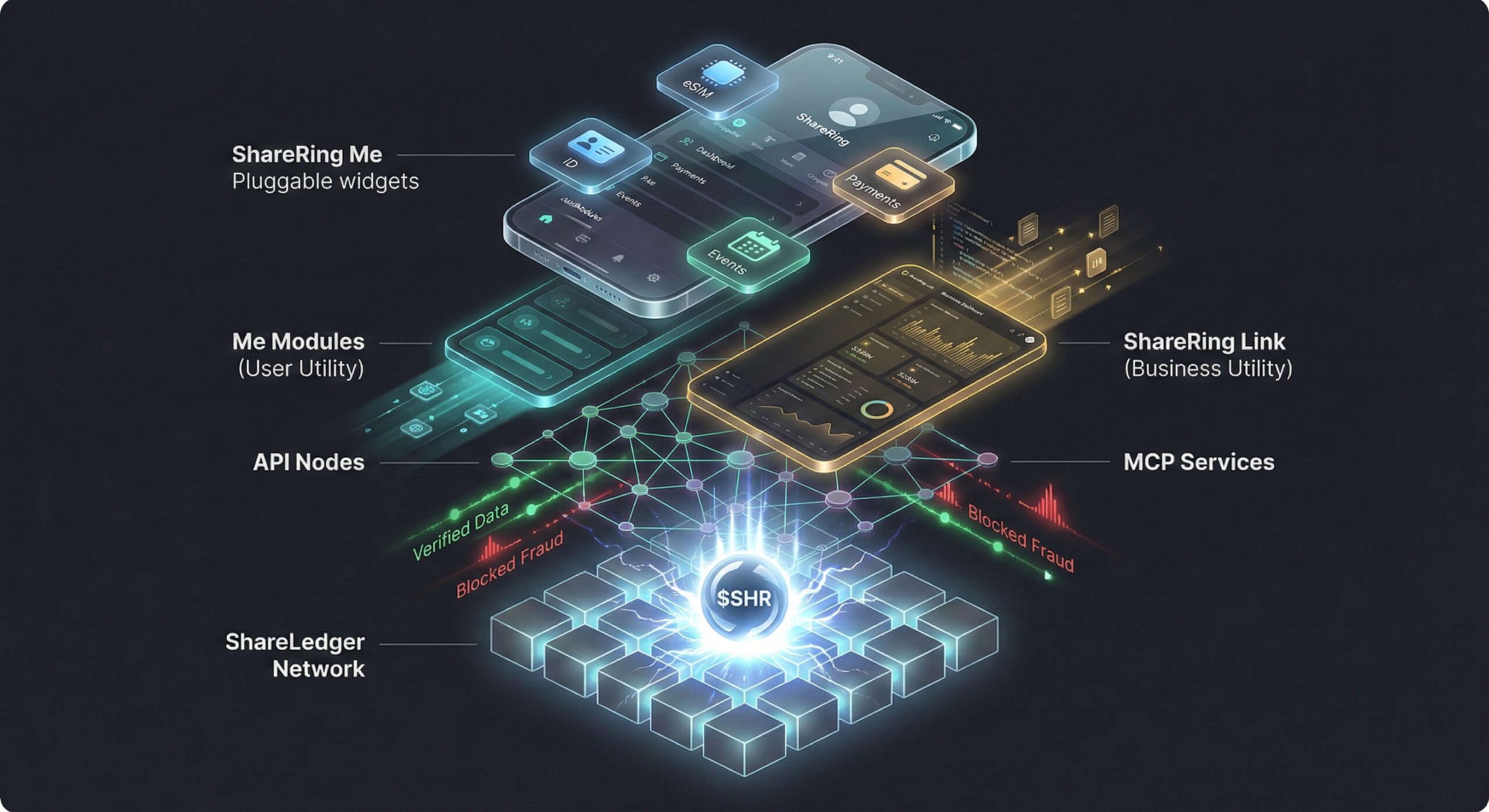

3. Product Ecosystem: The “Digital Twin” Architecture

“Digital Twin” remains the core vision: a unified, user-controlled identity that is portable, secure, and smart.

3.1 ShareRing Me: The Unified User Gateway

Launching in Q1 2026, the new ShareRing Me UX is a rethink of how users interact with their identity.

- Visual Trust Indicators: We want users to feel confident. Instead of a simple “confirm” button, they get a “Consent Receipt,” a clear explanation of exactly what data is requested and why.

- Vault Storage v3: Under the hood, we’ve rebuilt the storage engine. It uses background isolates to handle cryptography (ZKPs, biometric matching) without slowing down the app.

- Transaction Auth: We’re integrating capabilities that allow ShareRing Me to perform real-time transaction authorization.

- Instant ID: The new app will allow quick verification of your identity or age, online or offline.

3.2 ShareRing Link: The Self-Service Business Portal

ShareRing Link is evolving into a scalable SaaS platform.

- VaaS Bundles: We’re introducing pre-configured bundles in Q1 to reduce setup time. A business can pick an “Age Assurance 18+” bundle or a “UK Right to Work” bundle and get started with minimal configuration.

- Query Marketplace: Later in the year, we’ll launch a marketplace where developers can publish custom verification logic.

3.3 Technical Sovereignty: OIDC4VC & The Flutter SDK

We want ShareRing credentials to work everywhere.

- OIDC4VC Compliance (Q2): We’re self-certifying against the OpenID for Verifiable Credentials suite. Think of it as the “USB port” of digital identity, ensuring our credentials work with other global wallets.

- Flutter Vault SDK: This is already being tested by a partner and will be available for general release in Q2. It lets app developers embed ShareRing’s “Vault” technology into their own apps while using our secure architecture.

3.4 Me Modules: The Utility Engine

Me Modules are the “apps within the app.”

- eSIM: Continued growth, offering data in 190+ countries.

- e-Visa: A streamlined visa application module launching in Q3.

- New Modules: We will be developing and progressively deploying new Me Modules throughout the year, either with our partners, or as standalone tools that leverage your Digital Twin.

- Fraud Alerts: Modules that alert users if their identity is being used suspiciously.

4. Regional & Vertical Scaling Strategy

We’re targeting geographies where the need for verification is clear. Our primary markets are SE Asia, Australia, and the UK.

4.1 United Kingdom: The “Financial Services” and “Right to Work” Beachhead

The UK remains a key market.

- Right to Work (RtW): This is a solid business case. With increasing fines for illegal hiring, employers need a digital “statutory excuse.” ShareRing provides this by verifying biometric passports and checking status against Home Office databases. We’re targeting significant annualized check volumes in 2026.

- Partnerships: We’re working with partners like SelectID to expand reach, and expect to start reaping the benefits of this relationship soon.

- Financial Services: We’re targeting banks with our reusable, privacy first KYC solution, allowing customers to be onboarded remotely and without friction.

4.2 Thailand & SE Asia: Infrastructure Scale

In Thailand and SE Asia, we’re acting as a core infrastructure provider.

- Scale: We’re targeting substantial user growth over the next 12 months. This serves as the “top of funnel” for the ecosystem.

- Role Definition: We act as a Data Processor, minimizing regulatory liability while maximizing utility.

4.3 North America: Strategic Inroads

North America is on our radar. We’re seeing some promising inroads, specifically for age verification, e-commerce, and financial services.

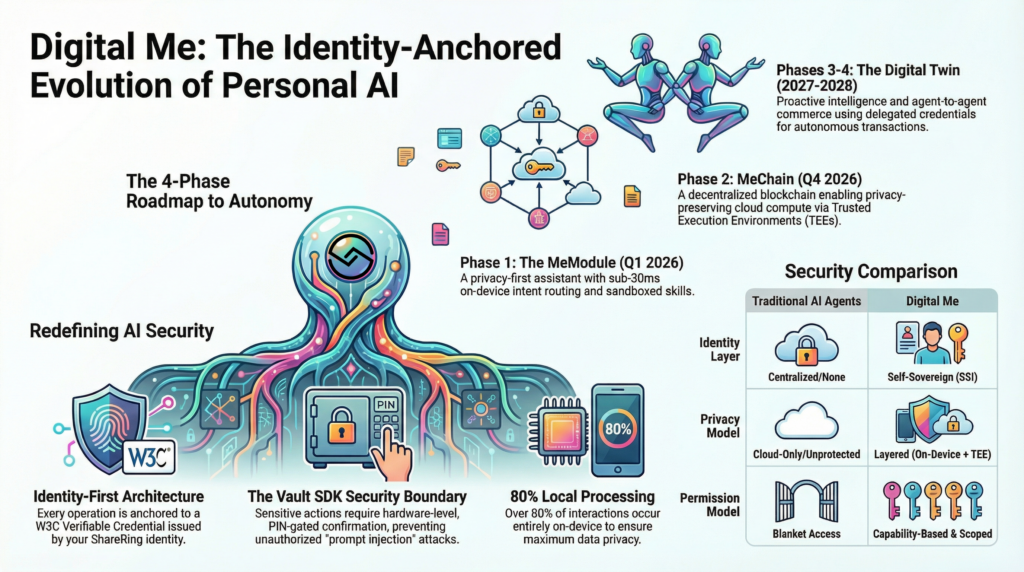

5. The AI Evolution: Smart Digital Me

2026 sees us move from “Static Verification” to “Active Intelligence.” This is the Smart Digital Me.

5.1 Decentralised AI Network

Smart Digital Me isn’t just a small language model. It’s a decentralised AI network, essentially Federated AI that token holders can participate in.

- Privacy Preserving: Current AI has privacy issues. ShareRing addresses this by allowing the AI to index verified documents locally.

- The Utility: A user can ask, “Am I eligible for a visa to Japan?” The AI checks the data locally and answers without personal data leaving the device.

5.2 Semi-Autonomous Agents

In Q4, we’re targeting an MVP of AI Agents. These agents can perform tasks like fetching a renewal form for an expiring passport and pre-filling it, moving identity from “passive storage” to an “active assistant.”

6. Commercial & Sales Roadmap

6.1 The “Ease of Doing Business” Transformation

We’re automating the sales cycle to remove friction.

- Self-Service Onboarding: ShareRing Link will allow merchants to sign up, select a bundle, pay, and get API keys quickly.

- VAR Enablement: We’re providing our VARs with white-label playbooks and co-branded materials so they can sell ShareRing solutions independently.

6.2 Marketing Strategy: Delivery-Led Credibility

Our marketing is about proof, not hype.

- Technology Papers: We’re releasing a series of technical papers to give developers and CTOs confidence that ShareRing is production-grade.

- Narrative Alignment: We’re aligning with DePIN and DeAI themes, positioning ShareRing as “Trust Infrastructure for DeAI.”

7. Tokenomics: The Strategy

The $SHR token is the economic engine of the ecosystem.

7.1 Transaction-Driven Buybacks

We’re implementing a sustainable, revenue-driven buyback model.

- Mechanism: When enterprise clients pay for verification services in fiat, a percentage is allocated to a “Buyback Treasury.”

- Execution: This treasury purchases $SHR from the open market. These tokens aren’t burned; they’re returned to the ecosystem (e.g., rewards pool for node operators). This creates a direct link: more real-world usage means more buying pressure on $SHR.

8. Risk Management

We’ve identified key risks and mitigation strategies:

- Regulatory Changes: Our platform is modular. If a government mandates a specific standard, we can swap out modules without rebuilding the stack.

- Adoption Friction: The “Seamless Verification” web SDK allows users to verify via browser without downloading the app initially, lowering the barrier.

- Competition: We focus on “High Assurance” niches (RtW, Finance, age assurance, e-commerce) where generic big-tech wallets often lack compliance or liability frameworks.

9. Conclusion

The 2026 roadmap reflects where we’re heading. ShareRing is moving from building out potential to executing on it. We’re deploying projects at scale in Asia, addressing KYC and labor compliance needs in Europe, and working on the convergence of AI and Identity globally. By focusing on transaction scale, technical sovereignty, and AI integration, we’re positioning ShareRing to become a core trust layer for the internet.